United States Commercial Display Market Size, Share, and COVID-19 Impact Analysis, By Display Type (Flat Panel Display, Flexible Panel Display, and Transparent Panel Display), By Application (Smartphone and Tablet, Smart Wearable, Television and Digital Signage, PC and Laptop, Vehicle Display, and Others), and United States Commercial Display Market Insights, Industry Trend, Forecasts to 2035

Industry: Electronics, ICT & MediaUnited States Commercial Display Market Insights Forecasts to 2035

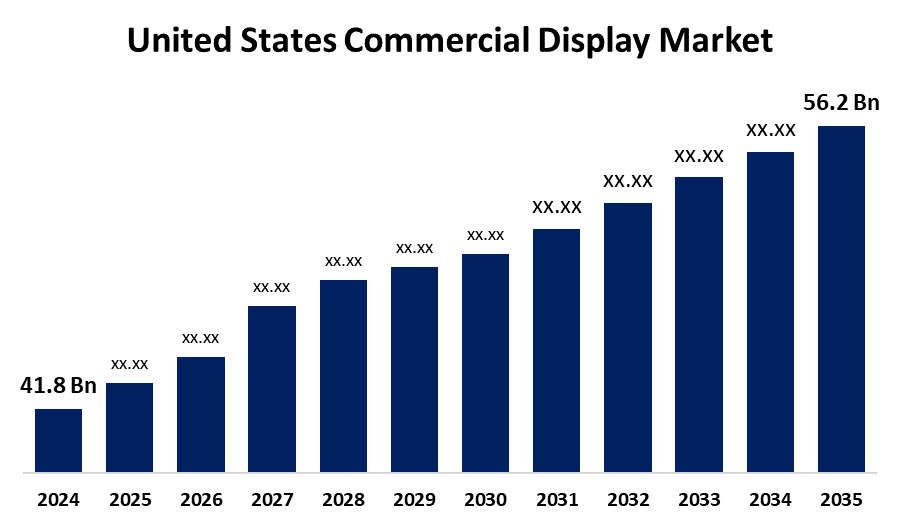

- The United States Commercial Display Market Size was estimated at USD 41.8 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.73% from 2025 to 2035

- The United States Commercial Display Market Size is Expected to Reach USD 56.2 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United States commercial display market is anticipated to reach USD 56.2 billion by 2035, growing at a CAGR of 2.73% from 2025 to 2035. The US commercial display marketplace is growing due to increased digital display adoption among industries, rising use of digital signage, and demand for high-def, interactive screens. Increased functionality is promoted by technological development, along with AI and cloud integration. Companies are also working on engaging customer experiences, driving further demand for innovative commercial display solutions.

Market Overview

The United States commercial display market refers to the displays utilized within business environments for applications such as digital signage, advertising, and customer information. The screens are designed to be run continuously and will often include added features like greater brightness, enhanced resolution, and special functions for special uses. The market is driven by several key drivers, including increasing demand for digital signage across sectors, increased use of interactive screens, and the adoption of new technologies like AI and IoT. In addition, the need for energy-efficient solutions and smart city development drives market growth. The US commercial display market provides a comprehensive range of display solutions for different companies across retail, hospitality, and education. The market also features specialized software and system integration services that serve the multiple needs of a variety of industries. The commercial display market in the United States is supported by the government through programs such as the GSA's Commercial Platforms program, enabling federal agencies to procure products from online marketplaces. Furthermore, governmental subsidies of education and classroom technology, as well as initiatives such as "Smart Stadiums," also fuel the commercial display demand.

Report Coverage

This research report categorizes the market for the United States commercial display market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the USA commercial display market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.S. commercial display market.

United States Commercial Display Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 41.8 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 2.73% |

| 2035 Value Projection: | USD 56.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Display Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Panasonic Corporation., NEC Display Solutions, Sony Corporation, BOE Technology Group Co., Ltd. (BOE), Innolux Corporation, LG Electronics Inc., Samsung Electronics, Panasonic, Sharp, Leyard Optoelectronic, Barco, Christie Digital, Planar Systems, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The U.S. commercial display market is growing robustly, fueled by technological innovation, industry-specific uses, and overall digital transformation initiatives. High-definition displays like 4K and 8K, as well as OLED and micro-LED technologies, are improving visual performance and power efficiency. Smart and interactive displays with touch functionality, AI, and IoT are enabling companies to provide customized content and simplify operations. Industry sectors are driving demand across the board, from retail uses video walls as a customer engagement tool, to transportation employing digital signage for live updates, and healthcare and education sectors depend on displays for communication purposes. Smart city programs are also embracing display technology to use for public information and surveillance. Cloud management solutions are facilitating remote control for companies over content, and regular investment in infrastructure and advertising continues to drive long-term growth. In general, commercial displays are increasingly becoming a necessity for enhancing engagement, efficiency, and brand presence in industries.

Restraining Factors

The United States' commercial display industry is hindered by high investment costs at the initial stages, deterring small and medium-sized companies from adopting them. High-tech advancements also challenge the industry with constant upgrades, translating to high operational costs. Saturation of urban markets also limits expansion opportunities. Environmental issues and regulatory compliance add complexity to the manufacturing and disposal processes. Finally, supply chain interruptions and shortages of chips affect manufacturing schedules and the supply of products, affecting the ability to deliver high-end display solutions constantly to different industries.

Market Segmentation

The United States commercial display market share is classified into display type and application.

- The flat panel display segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United States commercial display market is segmented by display type into flat panel display, flexible panel display, and transparent panel display. Among these, the flat panel display segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to LCD technology being the most utilized due to its cost-effectiveness, energy efficiency, and flexibility in adapting to a range of sizes and formats. LCDs are particularly dominant in large-screen applications, thus being the favourite in the flat panel display category.

- The smartphone and tablet segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The USA commercial display market is segmented by application into smartphone and tablet, smart wearable, television and digital signage, pc and laptop, vehicle display, and others. Among these, the smartphone and tablet segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The smartphone and tablet market in the U.S. displays a market, fueled by high demand for high-resolution screens, cutting-edge technologies such as OLED and AMOLED, and larger screen sizes. Edge-to-edge screens, foldable models, and in-display fingerprint readings increase attractiveness. Moreover, increasing availability of HD content and gamers favouring larger displays accelerate this segment's growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States commercial display market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Panasonic Corporation.

- NEC Display Solutions

- Sony Corporation

- BOE Technology Group Co., Ltd. (BOE)

- Innolux Corporation

- LG Electronics Inc.

- Samsung Electronics

- Panasonic

- Sharp

- Leyard Optoelectronic

- Barco

- Christie Digital

- Planar Systems

- Others

Recent Developments:

- In March 2025, Samsung Electronics America, Inc., announced the launch of its latest display technologies: The WAF Interactive Display (model WAFX-P), 105-inch 5K UHD Smart Signage (model QPD-5K), and 115-inch 4K Smart Signage (model QHFX).

- In September 2024, Panasonic Corporation of North America announced the launch of the Let’s note™ FV4 enterprise laptop in the U.S. Let’s note FV4 is a versatile, high-performance laptop designed for professionals working indoors, on the go, or in hybrid work environments. It delivers advanced computing and productivity engineered in a portable and secure laptop for today’s dynamic work styles.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States commercial display market based on the below-mentioned segments:

U.S. Commercial Display Market, By Display Type

- Flat Panel Display

- Flexible Panel Display

- Transparent Panel Display

U.S. Commercial Display Market, By Application

- Smartphone and Tablet

- Smart Wearable

- Television and Digital Signage

- PC and Laptop

- Vehicle Display

- Others

Need help to buy this report?