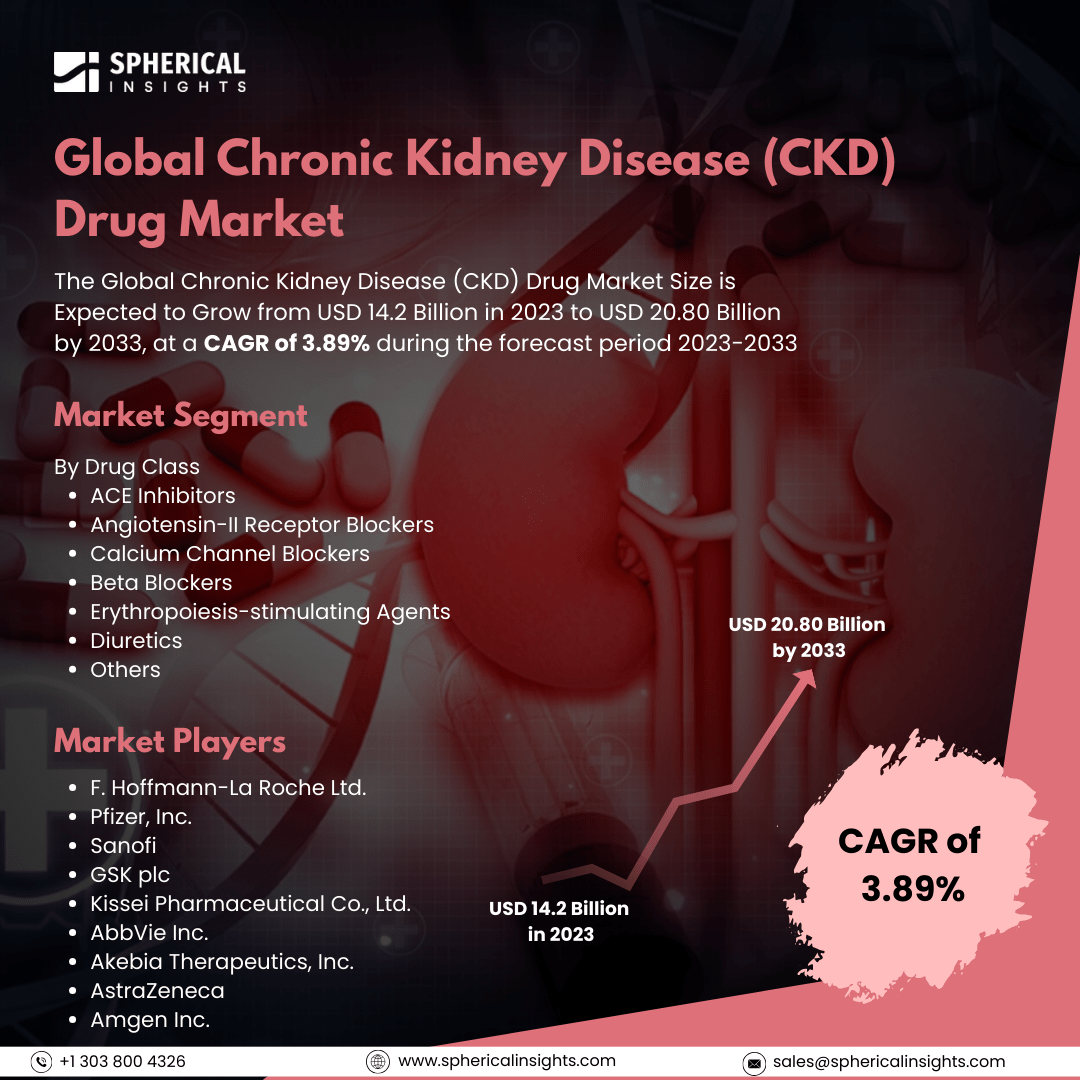

Global Chronic Kidney Disease (CKD) Drug Market Size to Exceed USD 20.80 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Chronic Kidney Disease (CKD) Drug Market Size is Expected to Grow from USD 14.2 Billion in 2023 to USD 20.80 Billion by 2033, at a CAGR of 3.89% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Chronic Kidney Disease (CKD) Drug Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (ACE Inhibitors, Angiotensin-II Receptor Blockers, Calcium Channel Blockers, Beta Blockers, Erythropoiesis-stimulating Agents (ESAs), Diuretics, and Others), By End-User (Hospitals and Specialty Clinics), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

The chronic kidney disease (CKD) drug market is the international industry dedicated to the development, manufacturing, and distribution of prescription drugs for treating and controlling chronic kidney disease (CKD). The market comprises drugs that help slow the progress of the disease, control its complications, and enhance the well-being of patients with CKD. Furthermore, the global chronic kidney disease (CKD) drug market is being pushed by growing cases of CKD, the aging population, and mounting awareness about treating and diagnosing CKD earlier. Developing treatments, expanding health infrastructure, beneficial government policies, and higher demand for individualized medicine add momentum to the growth of the market. Enhanced reimbursement policies and rising healthcare expenditures further fuel market growth. However, the high treatment costs, stringent regulatory approvals, limited patient awareness, reimbursement challenges, side effects of CKD drugs, and restricted access in low-income regions are key restraints for the growth of the market.

The ACE inhibitors segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the drug class, the global chronic kidney disease (CKD) drug market is divided into ACE inhibitors, angiotensin-II receptor blockers, calcium channel blockers, beta-blockers, erythropoiesis-stimulating agents (ESAs), diuretics, and others. Among these, the ACE inhibitors segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to their proven effectiveness in slowing CKD progression, reducing blood pressure, and protecting kidney function. Increasing CKD prevalence, widespread physician preference, and rising awareness about early disease management further drive the segment’s significant CAGR during the forecast period.

The hospitals segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

On the basis of the end-user, the global chronic kidney disease (CKD) drug market is divided into hospitals and specialty clinics. Among these, the hospitals segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is attributed to the high number of CKD patient admissions, the availability of advanced treatment options, and the presence of skilled healthcare professionals. Increasing government healthcare investments, improved diagnostic capabilities and the rising adoption of specialized CKD drugs further drive the segment’s remarkable CAGR during the forecast period.

North America is projected to hold the largest share of the global chronic kidney disease (CKD) drug market over the forecast period.

North America is projected to hold the largest share of the global chronic kidney disease (CKD) drug market over the forecast period. The regional growth is expanded to the high prevalence of CKD, advanced healthcare infrastructure, and the strong presence of key pharmaceutical companies. Favorable reimbursement policies, increasing healthcare expenditure, rising awareness about early disease management, and continuous advancements in drug development further drive the region’s significant market share during the forecast period.

Asia Pacific is expected to grow at the fastest CAGR growth of the global chronic kidney disease (CKD) drug market during the forecast period. The regional growth is attributed to the rising prevalence of CKD, increasing healthcare investments, and expanding access to advanced treatments. Growing awareness, a large aging population, government initiatives, and the presence of emerging pharmaceutical markets further drive the region’s rapid expansion in the CKD drug market during the forecast period.

Company Profiling

Major vendors in the global chronic kidney disease (CKD) drug market are F. Hoffmann-La Roche Ltd., Pfizer, Inc., Sanofi, GSK plc, Kissei Pharmaceutical Co., Ltd., AbbVie Inc., Akebia Therapeutics, Inc., AstraZeneca, Amgen Inc., Teva Pharmaceutical Industries Ltd., and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In July 2023, Eli Lilly and Company and Boehringer Ingelheim declared that Jardiance (empagliflozin) has received European Commission (EC) approval for the treatment of adults with chronic kidney disease.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global chronic kidney disease (CKD) drug market based on the below-mentioned segments:

Global Chronic Kidney Disease (CKD) Drug Market, By Drug Class

- ACE Inhibitors

- Angiotensin-II Receptor Blockers

- Calcium Channel Blockers

- Beta Blockers

- Erythropoiesis-stimulating Agents (ESAs)

- Diuretics

- Others

Global Chronic Kidney Disease (CKD) Drug Market, By End-User

- Hospitals

- Specialty Clinics

Global Chronic Kidney Disease (CKD) Drug Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa